Why ESG Matters

Julie Rosa and Alexandra Burger

The Evolution of ESG

We have seen a significant increase in the focus on ESG in general over the last 5 years with a growing scrutiny that has peaked over the last 18 months. Media coverage of ESG went up by 75% in 2020 over 2019 in the global sample[1] of influential media; and has continued to rise. This has been driven by a combination of investors, regulators, government and from the broader stakeholder community, as consumers and society have become more aware of the effects of climate change, the environment and social inequality. The ‘old school’ thinking was that ESG was equated with CSI, it was a nice to have, an add on to appeal to a smaller, more focused pool of investors not really going to make much of a difference to your organisation.

ESG has become significantly entrenched in the local and international investment world since the early days of the Equator Principles (launched in 2003) now adopted by 135 financial institutions in 135 countries (including ABSA, FirstRand & Nedbank) The UN Principles for Responsible Investment (PRI) are considered to be the world’s leading proponent of Responsible Investment has shown rapid growth from 2006, with over 4900 signatories worldwide. Asset Managers, Institutional Investors, Infrastructure Investors, Banks, Private Equity, and other investment managers have embraced ESG/Impact investing from developing ESG investment Funds to adopting ESG wholesale into their organizations. For example, Development Finance Institutions who provide tens of billions of Dollars in development finance annually tend to integrate ESG thinking into their decision making, many who have their own ESG standards. Closer to home, sustainable investments were incorporated into the Pension Fund Regulations on investments around 2010 onwards.

From a company perspective, research shows that excess returns can be attributed to ESG (this could be from a combination of factors like green attributes, attracting and retaining high caliber talent, lower cost of capital, benefit from capital flows among others), ESG acts as a cushion during rough times, it promotes forward and multidimensional thinking, helps companies to be adaptive and resilient – it is clear that ESG is a core component of business strategy, so that companies stay relevant and respected, and now ESG sits at the heart of good business practice, and for some companies it has become a strategic pillar. Companies of all sizes need to respond.

What has brought on the ESG wave and the trends in ESG

The push for the inclusion of ESG has come from many sources e.g., Finance Institutions, local and international regulators, institutional and private investors, Insurers, legal firms, accounting firms, legislative interventions and there is now a significant groundswell from the general public.

Climate reality is one of the driving forces for the increase in interest in ESG, with all eyes on climate risk and the opportunities associated with it. Say on Climate [SOC] is growing and there is growing recognition of the need for every company to publish a climate transition action plan. G30 report co-chaired by Mark Carney and Janet Yellen says: “At a minimum, companies will have to set out targets for their Scope 1, 2 and 3 emissions, and set credible milestones.” Regulators and standard setters are moving towards requiring disclosure of plans and the pressure is mounting for Climate action plans.

Social inequalities and social justice also became a focus area with the ‘Black Lives Matter’ and ‘Me Too’ movements which highlighted these issues. Diversity, Equity, and Inclusion (DEI) have also gained a lot of focus. DEI is a movement that recognizes and works to ensure equal opportunities within companies as well as recognizing differences in backgrounds, cultures, skill-sets, and perspectives. Diversity equity and inclusion emphasizes understanding and empathy as key elements to diverse and inclusive teams[2]

There has been an increase in regulation and government intervention with the Green Finance Taxonomy, The

Carbon tax Act, The Climate Change Bill. The increase in regulation has implications for companies of all sizes.

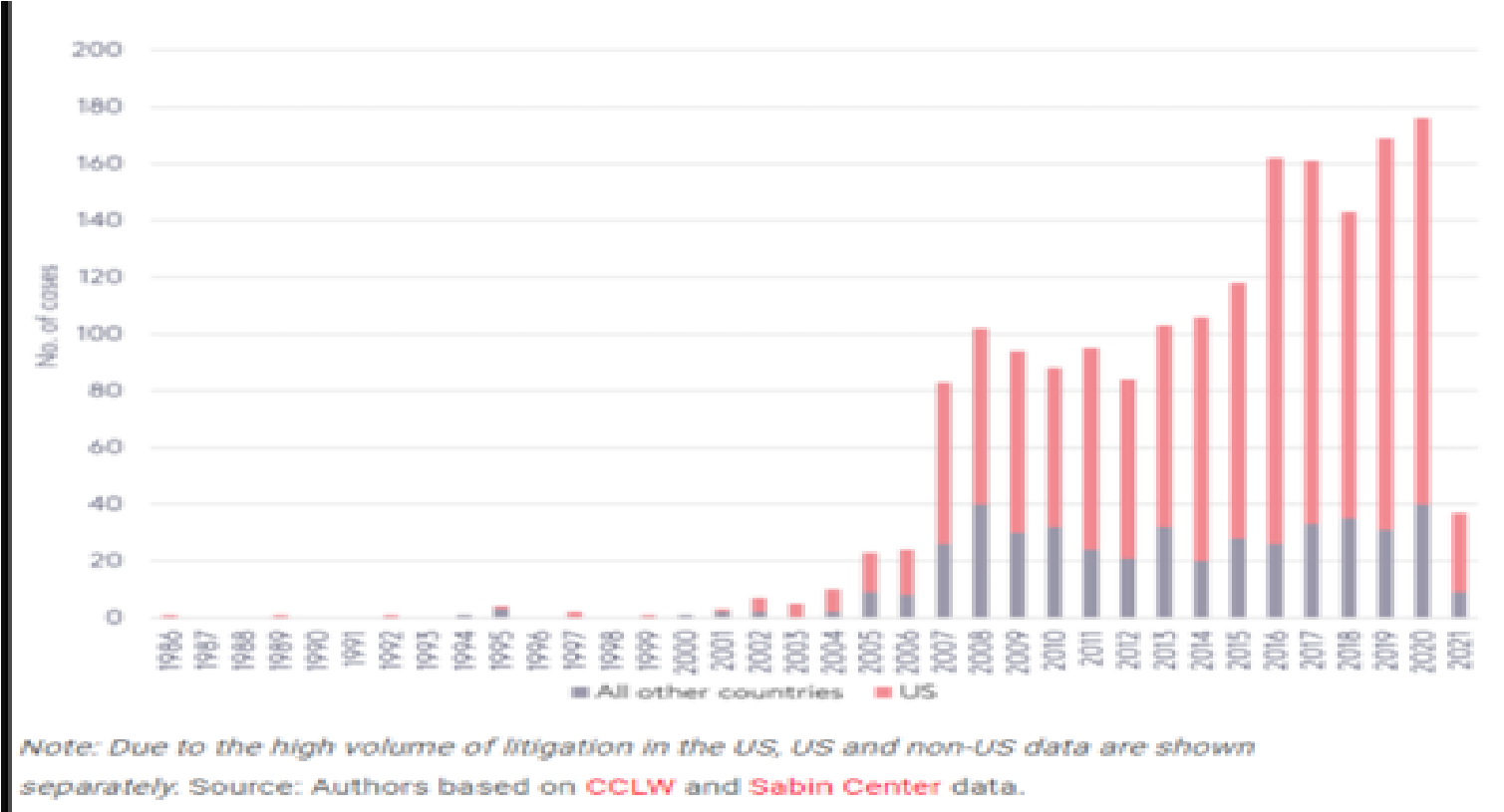

Also on the legal front there has been a clear upward trend in climate litigation matters, according to the Harvard

Law Review until 2017, the total number of climate litigation cases was 884 across a total of 24 countries, with 654 of

these cases being in the United States. By 2020, this number had nearly doubled to 1,550 cases across 38 countries[3].

Corporate accountability has become particularly important.

The graph below shows the increase in climate litigation matters.

In the reporting and disclosure areas we have seen some great strides forward since one of the most frequent criticisms of ESG is that companies can cherry pick which standards they report against, what information to disclose and often the information is not assured. Investors have been calling for increased disclosure and transparency. Last year saw a significant leap forward in solving this reporting problem with the IFRS formally announced the International Sustainability Standards Board (ISSB) which aims to bring about high quality, transparent, reliable, and comparable reporting by companies on climate and other environmental, social and governance (ESG) matters[4]. There is mounting pressure for companies to make better disclosures and to have the data.

Calls from shareholders to link executive remuneration to ESG metrics has also been a big focus area, and globally more and more companies are now linking pay to ESG performance measures in both the Short-Term Incentives and the Long-Term Incentive Plan – the idea is to bring focus to the long terms effects that the company has on the environment and society and not only the short-term share price. In South Africa between 65 and 75% of companies are now linking ESG to pay and this is increasing.

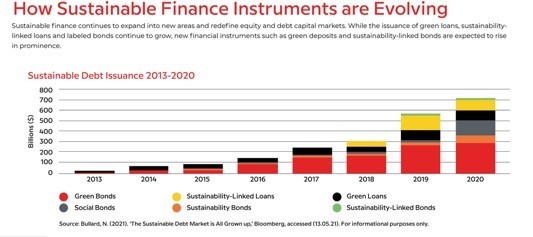

As per the old adage, follow the money, it’s easier to follow the driving force of ESG funding. For example, there has been a dramatic fund flow into sustainable funds. According to Morningstar the number of sustainable funds globally reached 5,932 at the end of 2021, up 11% in the last three months of the year from 5,330 funds in the third quarter. Year on year, the global sustainable fund universe expanded by 53%. There are combination of new fund launches and repurposing of existing Funds. Over the last 3 years ESG bond assets have increased 3-Fold and reached $350 Bn in 2020. DFIs make billions of dollars in financing utilizing their own ESG lenses.

ESG investments have developed across debt and equity investing, from private to institutional funding, into infrastructure, property, private equity and now venture capital. Many novel instruments have been developed along the way e.g., the early days of the carbon emission reduction credits to sustainable bonds, loans. Private Equity was an early adopter of ESG Financing. DFI investments in ESG is a major driving force in this area. Many investors require adherence to ESG principles in all their investments. Many private Equity Managers and Funds use ESG Benchmarks, some proprietary but generally a generally accepted benchmark or a combination of benchmarks. In many case it is included in the initial screening, at due diligence and there may be quarterly or annual reporting. There are many seasoned firms providing ESG due diligence and reporting, some of whom have developed automated systems and products.

The move from a tick box exercise to an approach that looks at the company holistically.

The flip side of all the focus on ESG is that there has also been more greenwashing and rainbow-washing (which

is the profit-driven practice of deceptively communicating unsubstantiated values in products (and services)) in

order to appeal and market them better.[5]). According, to advertising firm Ogilvy and Mather,

greenwashing practices are growing in the last decades to epidemic proportions[6].

Greenwashing scandals often go viral and can cause reputational damage to a company as well as increasing the

risk of class action lawsuits and private litigation. [Some examples are Red Lobster, who are facing a class

action lawsuit for marketing Marine Lobster and shrimp as sustainable when its suppliers use practices that

are harmful to the environment and are inhumane; and the Coca Cola Company who are facing a private lawsuit

for marketing itself as sustainable and environmentally friendly while generating more plastic pollution that

any other company in the world. [7]] The bottom line is that with increased

scrutiny, if companies make disclosures – they need to have the data to back them up.

What does this mean for companies?

All companies in all industries need to consider ESG. Whether the company is already selling an environmentally friendly product or service or whether they are for example an industry with a negative environmental impact, they need to consider what they can do to reduce their negative impact. The pressure is effectively coming from all sides: regulators, legislators, lenders, and investors (banks, private equity, and debt), insurers and customers. Note the focus is often on environmental compliance but governance is essential to investors and lenders and social impact is an area which is often lacking and provides many opportunities.

Given the changes and complexity in the ESG space, companies should understand what is important and relevant to their unique circumstances and how to respond to the investor and broader stakeholder expectations – to be ahead of the game. This is like a compass or GPS for ESG and informs strategy and guides decision making. Understanding the ESG risks and opportunities can often mean that there is more opportunity for innovation and to accessing sustainable capital and lowering your cost of capital, to look ahead and think in different dimension which will ultimately help with the resilience of your organisation.

TALK TO US – BE AHEAD OF THE GAME

- 1. https://www.consultancy.eu/news/6109/global-media-coverage-of-esg-investment-has-exploded

- 2. https://www.esgthereport.com/what-is-diversity-equity-and-inclusion/

- 3. https://corpgov.law.harvard.edu/2022/03/03/the-rise-of-climate-litigation/

- 4. https://www.ifrs.org/groups/international-sustainability-standards-board/

- 5. https://www.sustainablefashionmatterz.com/what-is-colorwashing

- 6. https://enveurope.springeropen.com/articles/10.1186/s12302-020-0300-3

- 7. https://truthinadvertising.org/articles/six-companies-accused-greenwashing/